As we stand at the crossroads of economic transitions, the confluence of historical data, high inflationary pressures, central banks tightening financial conditions, and the potential for deflation creates a complex tapestry that demands careful examination. We will explore the historical context surrounding such economic shifts, the likelihood of deflation, and the intriguing phenomenon of gold emerging as a bullish asset in times of deflationary risk.

Inflation decreases the value of savings and debt.

Deflation increases the value of savings and debt.

Historical Precedents:

Throughout economic history, the pendulum has swung between periods of inflation and deflation, often influenced by shifts in monetary policies, global events, and economic imbalances. The aftermath of high inflationary periods, when central banks implement measures to tighten financial conditions, can sometimes lead to deflationary pressures.

High Inflation and Central Bank Responses:

Instances of high inflation have historically prompted central banks to respond with tightening financial conditions. By raising interest rates and implementing other measures to curb inflation, central banks aim to bring about monetary stability and avoid the erosion of purchasing power.

Deflationary Risks:

However, the tightening of financial conditions, if too abrupt or if faced with external shocks, can tip the delicate balance towards deflation. Deflation, characterized by a general decline in prices, poses challenges for economic growth as consumers delay spending in anticipation of lower prices in the future.

Deflation and the Paradox of Gold:

In the traditional economic narrative, deflation is often associated with negative consequences for asset prices, including commodities. However, the historical performance of gold during deflationary periods challenges this conventional wisdom.

Safe-Haven Appeal:

Gold, often referred to as a “safe-haven” asset, tends to exhibit a counterintuitive bullishness in the face of deflationary risks. Investors flock to gold as a store of value during times of economic uncertainty, viewing it as a hedge against currency devaluation and the potential erosion of other asset values.

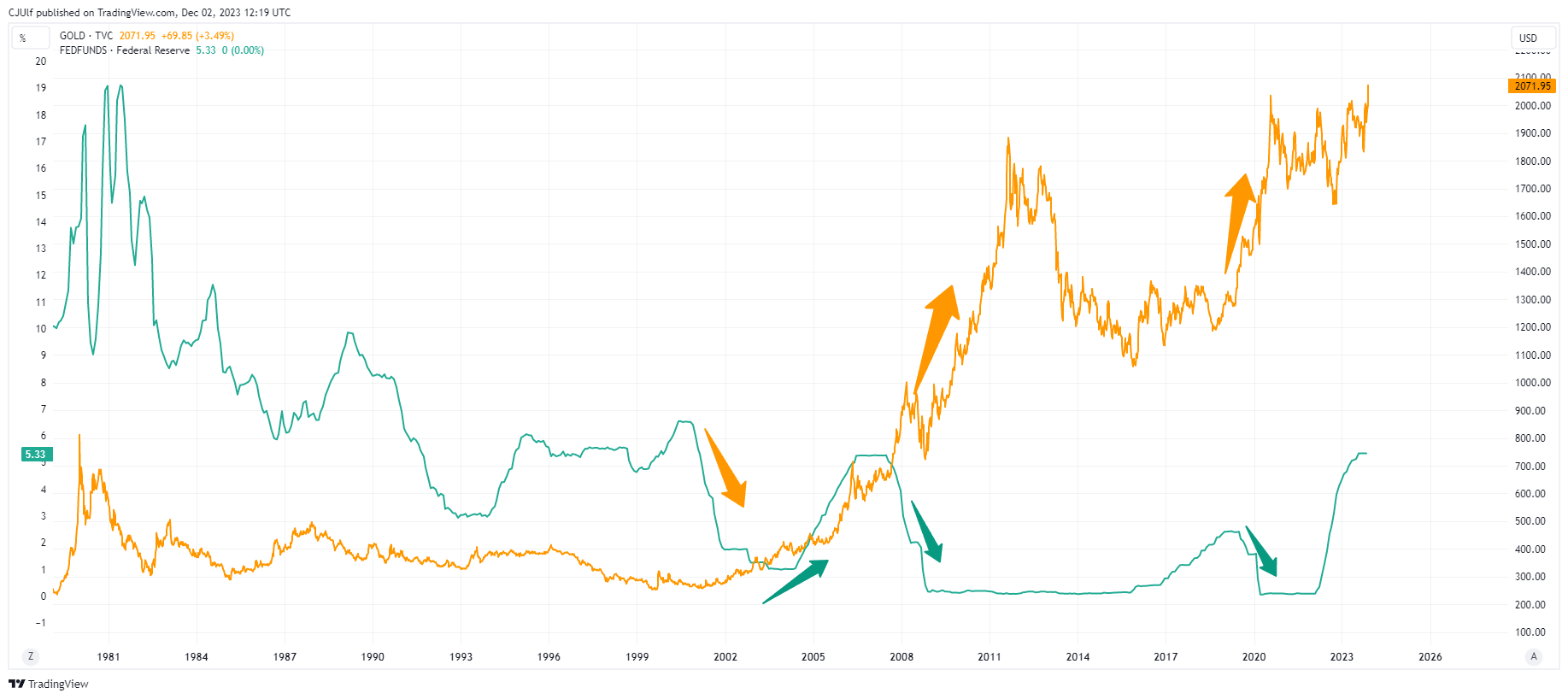

Real Interest Rates and Opportunity Cost:

The relationship between real interest rates and gold prices is a crucial factor. In deflationary environments, central banks may implement policies that result in nominal interest rates declining more slowly than the overall drop in prices. This can lead to an increase in real interest rates, making holding non-interest-bearing assets like gold relatively more attractive.

Diversification and Portfolio Insurance:

Investors often turn to gold as a diversification tool and portfolio insurance during times of economic turbulence. The precious metal’s ability to retain value in the face of currency devaluation and its historical role as a “safe-haven” contribute to its appeal as an asset that may weather the storm of deflation.

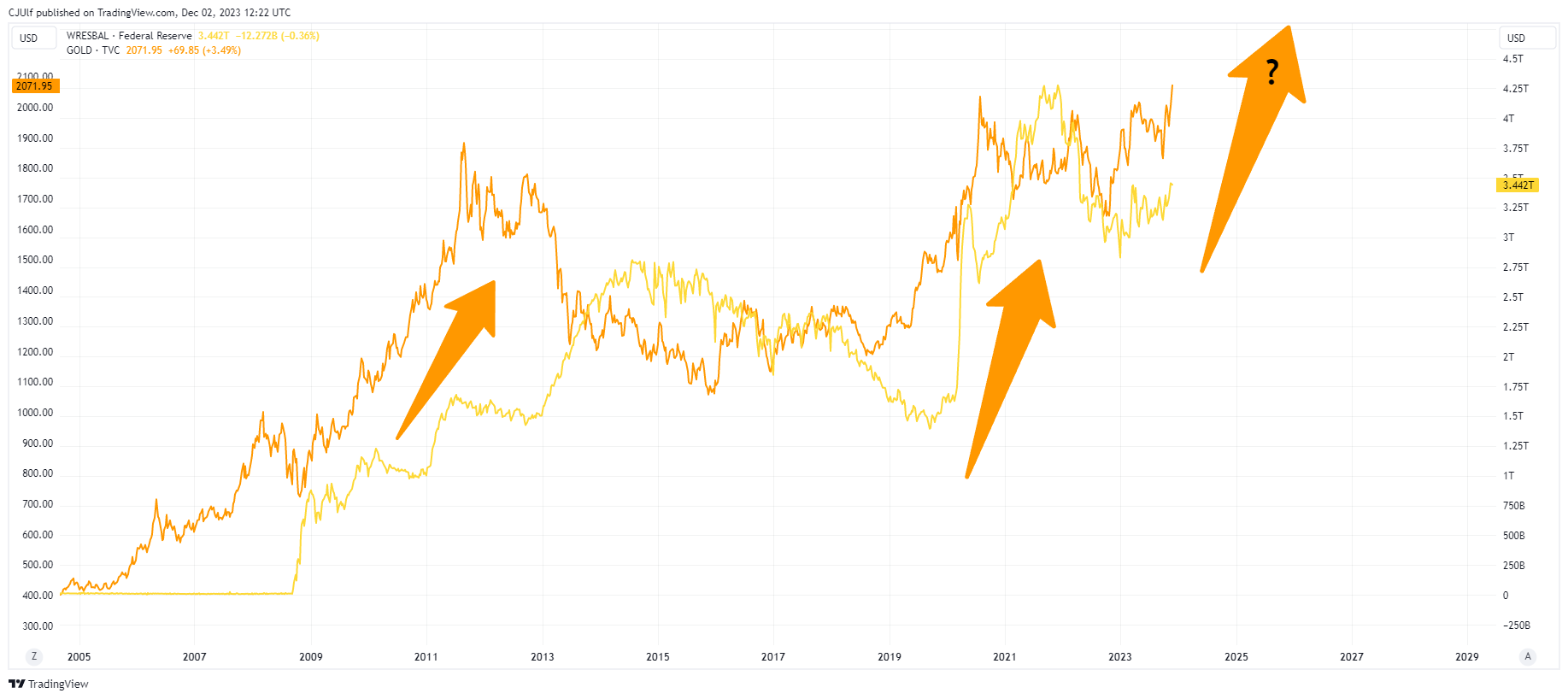

Market analysis

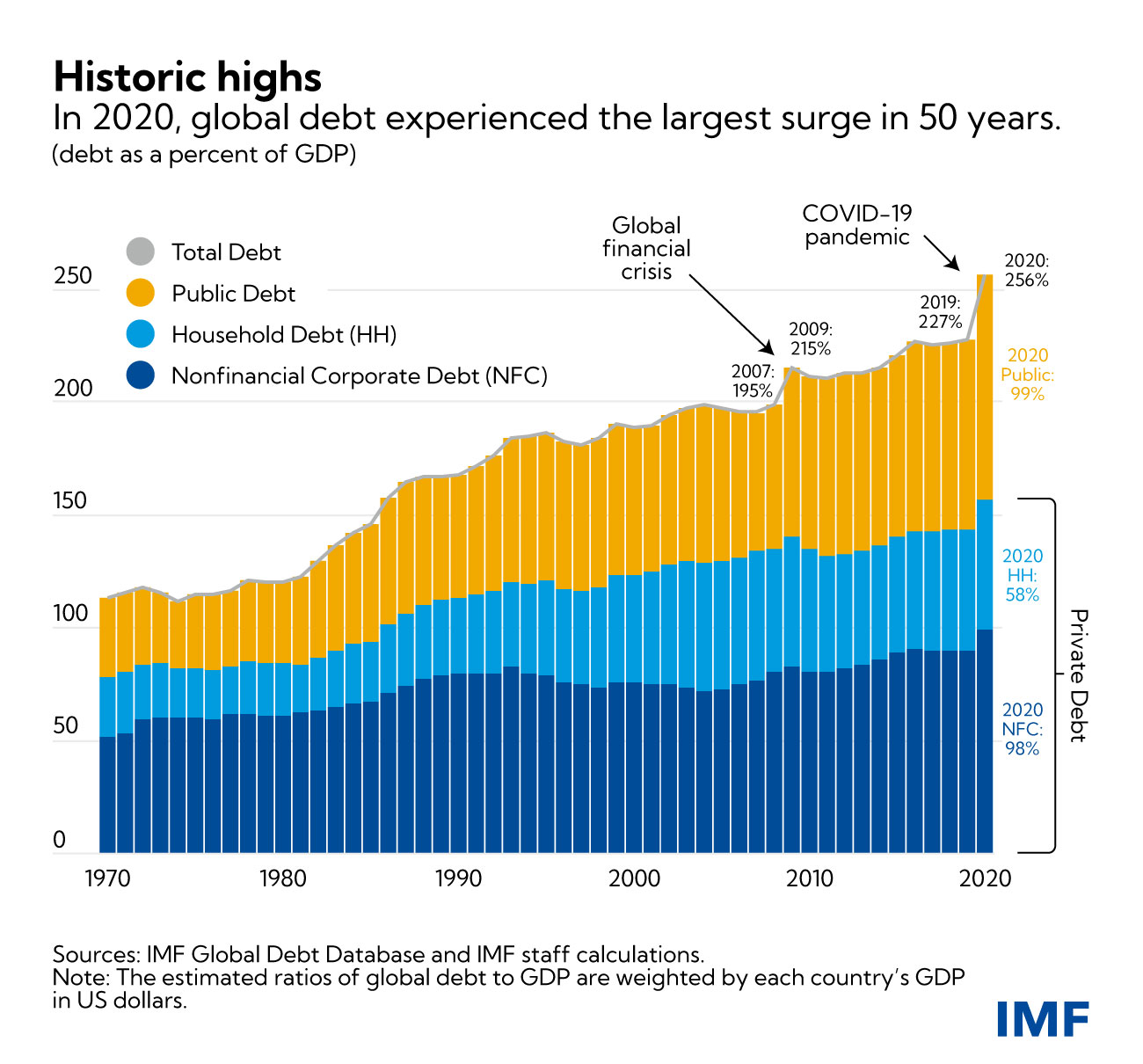

Debt level relative to GDP is exponentially increasing. The danger of deflation is hence explicitly linked. Hence, following inflation, following a tightening cycle, the risk of deflation guarantee ever larger stimulus.

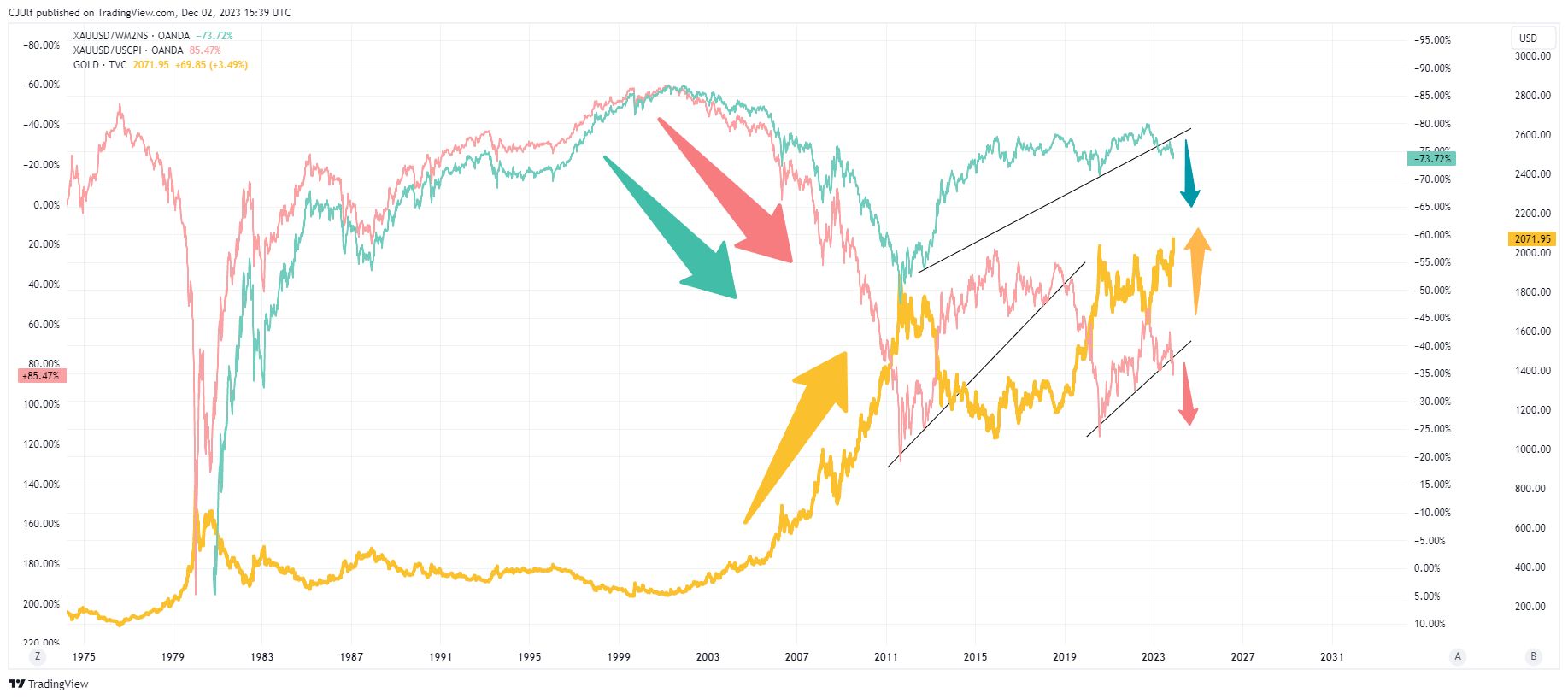

Why gold?

Gold preserves value in a world of devaluing fiat currency. The world has never been more indebted than it is now. The more debt, the more dangerous deflation is. Why is gold tracking the ratios in the charts? Because the threat of deflation guarantees monetary debasement.

Conclusion:

As we navigate the economic landscape of 2022, the interplay between high inflation, central bank responses, and the specter of deflation underscores the need for a nuanced understanding of asset dynamics. The historical data suggest that gold, traditionally viewed as a hedge against inflation, can also emerge as a bullish asset during deflationary risks.

The paradox of gold thriving in deflation lies in its unique qualities as a store of value, a safe-haven asset, and a portfolio diversifier. Investors, recognizing the potential for deflationary headwinds, may turn to gold as a means of preserving capital and seeking refuge from the uncertainties that accompany economic contractions.

While economic transitions can be fraught with uncertainties, the historical resilience of gold in the face of deflationary risks invites a closer examination of its role in diversified investment portfolios. As the economic narrative unfolds, the relationship between deflation and gold prices serves as a reminder that, in the world of finance, paradoxes and unexpected correlations can shape the trajectory of asset values and investment strategies.